Autonomous Trucks: Disruption on Wheels?

The vision of self-driving trucks transporting cargo on highways across countries has already taken root in the public imagination. There are the true believers who see self-driving trucks as both immanent and disruptive, as well as skeptics who say it will still take decades to happen. But most likely the outcome lies between those two extremes.

At the beginning of last December, Plus.ai, an AI startup based in Cupertino, California, made the world’s first cross-country trip using a self-driving commercial freight truck to deliver butter to a small town in Pennsylvania. While this isn’t the first time an autonomous truck has made a cross-country trip, it’s likely the first time a commercial freight truck has made a real delivery like this.

Autonomous trucks (ATs) are likely going to become mainstream before any self-driving consumer vehicles. According to a McKinsey report issued last year, autonomous trucks will change the cost structure and utilization of trucking—and, together with that, the cost of consumer goods.

The trucking industry is still deeply traditional, with few major or structural changes implemented in the past decades. Labor shortage of truck-drivers in Europe and the US – where trucking is primary method for shipping goods – is also threatening the industry since 2003, according to the Bureau of Labor Statistics (BLS). Following other industries disruption – such as Airbnb for hospitality and Uber for ride-hailing – this conservative orientation is all about to change. Companies have already made fully commercial deliveries – Anheuser-Busch and Plus.ai – and struck alliances to operate ATs jointly. There are a number of startups and established companies working on autonomous trucking. From Plus.ai, Kodiak, Einride, and TuSimple – which has recently partnered with UPS – to Waymo and Daimler. On the other hand, Uber shuttered its program in summer 2018, after one of its self-driving SUV test vehicles killed a pedestrian. These companies are typically using new trucks, outfitted with lidars, sensors, and other technologies to allow the vehicle to operate without human intervention.

SLOW DISRUPTION BRINGING HIGH BENEFITS

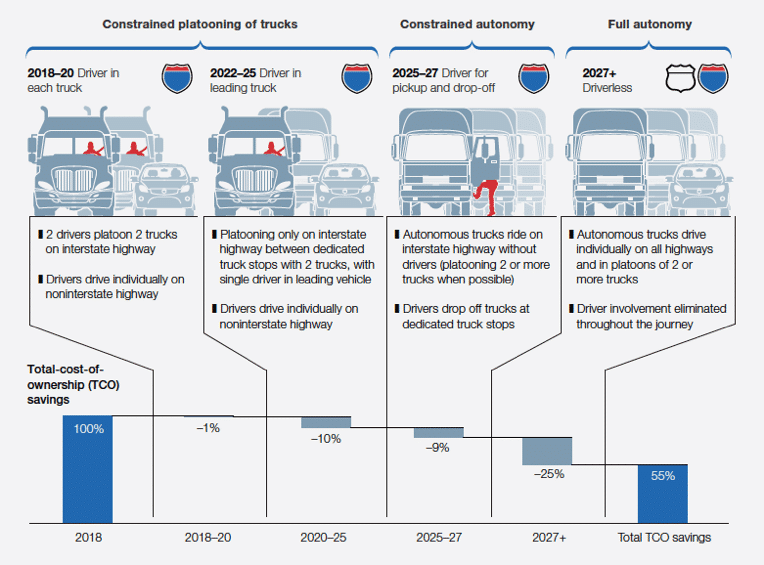

As observed by McKinsey , potential transition to autonomous trucks is expected to come in in a series of consecutive waves, increasingly reducing the percentage operators’ total cost of ownership (TCO). The first two waves will feature “platooning,” a technique to connect wirelessly a convoy of trucks to a lead truck, allowing them to operate safely much closer together and drive fuel efficiencies.

- Over the next 3-5 years, networks of connected convoys will develop, utilising algorithms to link up. Companies will be able to use platooning techniques to transport their goods, although still requiring a driver in each truck (the international Society of Automotive Engineers – SAE – calls this Level 3 autonomy, or “conditional automation”).

- In about 5-7 years, the next wave, driverless platooning, will take place. On interstate highways, these platoons will feature a driver in the lead truck and self-driving trucks following close behind.

- In roughly 7-10 years, constrained autonomy (SAE International calls this Level 4 autonomy) is expected to hit the transportation industry. Self-driving trucks will operate throughout the interstate highway system without a platoon. Nonetheless, constrained autonomy will still be subject to weather and visibility conditions, and developments in infrastructure – such as the ability to communicate with traffic lights. Drivers will meet the trucks at the highway exit and drive them to the ultimate destination, navigating city streets, local and pedestrian traffic, parking lots, and loading docks.

- More than 10 years from now, the first fully autonomous trucks are expected to operate at scale without drivers from loading to delivery (Level 5 in the SAE International framework).

Lower operators’ TCOs are only one of the effects of ATs on trucking—the industry most obviously affected. On top of that, fuel consumption and the overall industry’s carbon footprint are expected to decrease, as well as cost structures and operating models are forecasted to change.

Figure 1: AT disruption is likely to come in 4 major waves

Source: Route 2030: The fast track to the future of the commercial vehicle industry. September 2018, McKinsey.com

HOW WILL ATs TRANSFORM THE TRUCKING INDUSTRY?

-

Decrease in operating costs, increase in asset prices

Although initial savings will be small, with full autonomy arriving sometime in 10 to 15 years, costs of ownership will fall by 45 % from today’s costs. The biggest chunk of that savings will be on labour, which helps tackling the current drivers-shortage affecting western countries. Nonetheless, this outcome doesn’t necessarily mean bad news for today’s truck drivers. Autonomy will first take root on long-haul trips, which are the least popular among commercial truck-drivers today. The industry’s driver shortage is concentrated in these routes. McKinsey anticipates an increase in technical jobs to service and maintain the IT infrastructure that ATs need and job growth because of the need for local drivers to navigate ATs from the highways to their destinations and back.

AT substitution will come slowly, and, in the meantime, demand for non-autonomous vehicles will continue. However, companies investing in new technology will bear the risk of uncertain final outcome. This risk, combined with more complex maintenance and open questions regarding liability, might accelerate the industry-wide trend to outsource fleet management.

-

Better utilization of latent capacity

ATs are not subject to hours-of-service regulations, which limit the time a driver spends behind the wheel. By increasing driving hours from 11 hours per day to 20, ATs will be able to move freight faster and more flexibly, which will also allow shippers’ supply chains to run faster. If demand grows, the national fleet could accommodate it without growing and so remain about the same size.

-

Industry consolidation

ATs might cause a greater share of the market to consolidate in the hands of the big trucking companies at the expense of owner–operator companies and other small companies. ATs are better able to take advantage of optimized routing software, which can identify backhaul opportunities and allow larger companies will create more efficient platoons.

These factors suggest that the current highly fragmented industry structure, in which each company owns only a few tractors, will come under pressure. ATs and their technologies will be most easily deployed and exploited by larger carriers, which might claim a larger share of the industry as a result.

Figure 2: Factors influencing the rate of ATs adoption

| TECHNOLOGY | Current testing indicates that ATs are ready to be deployed in many standard environments but not yet ready to handle uncommon “edge” cases. Incidents during AT testing have shown that the algorithms and sensors have room to improve, deep learning (an artificial intelligence technique) will improve the software with each mile driven. |

| ECONOMICS | Economically, ATs could be more than 1.5 times more expensive than conventional trucks, requiring a higher initial investment by trucking companies and assurance of the total-cost-of-ownership savings. |

| REGULATION | For ATs to efficiently operate cross-borders, it is fundamental that countries implement and align regulations and standards concerning ATs circulation on public highways. |

| INFRASTRUCTURE | ATs can reduce congestion by traveling closer together, but companies would need to replace more than half of their fleets to realize that benefit. Additionally, “platooning” might require depots to assemble convoys. Public or private highway-access points would also ease the path to full autonomy. |

TOWARDS A CHANGE IN THE ENTIRE TRANSPORTATION ECOSYSTEM

The forces unleashed by ATs have the potential to change the ecosystem dramatically. Industry consolidation would transform a fragmented industry that struggles to attract sufficient drivers into a digitally enabled short list of providers. Original equipment manufacturers (OEMs) and new entrants might compete for transportation-as-a-service share. And companies might tap their latent capacity through near-24-hour operations.

For carriers (indeed, for most logistics sub-sectors), ATs are likely to bring disruption to fuel efficiency, operating models, cost structures, and economic models. And what’s more, self-driving trucks are only one of the significant disruptions that are expected to hit the transport & logistics industry.